- QUICKBOOKS WORKFORCE PAYROLL SUPPORT FOR FREE

- QUICKBOOKS WORKFORCE PAYROLL SUPPORT SOFTWARE

- QUICKBOOKS WORKFORCE PAYROLL SUPPORT TRIAL

Note that neither QuickBooks nor OnPay offers international payroll services. QuickBooks Payroll Elite users get additional coverage of up to $25,000 for any payroll fines incurred, including those incurred not by QuickBooks’ errors but your own.

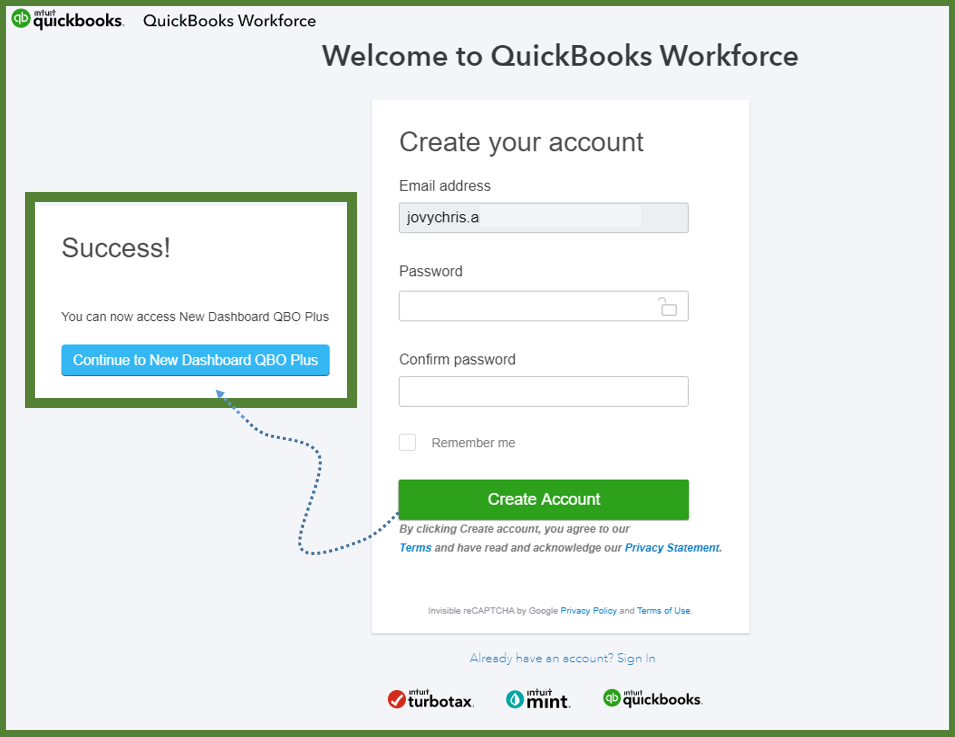

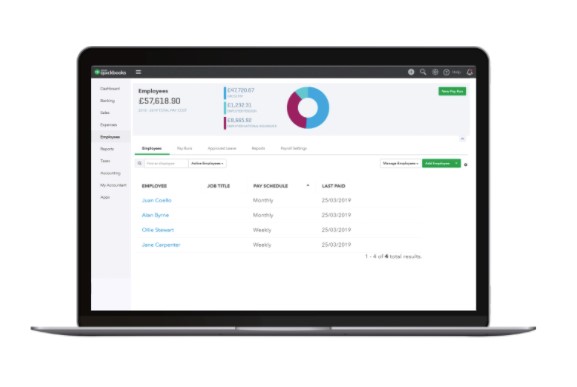

Since they file taxes on your behalf, QuickBooks Payroll and OnPay issue a tax-filing guarantee: If they make a mistake with your taxes, they’ll pay the resulting penalties and fines and deal directly with the IRS on your behalf. QuickBooks Payroll Dashboard (Image: QuickBooks)

QUICKBOOKS WORKFORCE PAYROLL SUPPORT FOR FREE

(Employees can access their tax forms for free using each provider’s self-service portals.) Figure A. Both also draw up 1099 and W-2 end-of-year tax forms, though both providers charge an extra fee if you want to print and mail these tax forms to your employees. Both providers offer full-service payroll plans only, meaning they will calculate, deduct and file your federal and state payroll taxes on your behalf. OnPay: Feature comparison Payroll processing and tax filingīoth QuickBooks Payroll and OnPay excel at payroll processing and tax filing. OnPay is simply one of the only providers to explain its fees transparently instead of hiding them in the fine print.

QUICKBOOKS WORKFORCE PAYROLL SUPPORT SOFTWARE

For instance, you’ll be charged a fee if you have insufficient funds to cover a payroll run, which is true for all payroll software systems. And while OnPay has a few extra charges, it lists those fees upfront, and none of them are outside the industry norm. Naturally, all of OnPay’s features are included in its single plan. Your monthly payment only changes when you add more employees - a transparent model well-suited for small businesses. The first month is free and includes white-glove setup and migration (at no additional cost).

QUICKBOOKS WORKFORCE PAYROLL SUPPORT TRIAL

QuickBooks Payroll also offers a 50% discount for the first three months, but you have to waive the free trial to get the discount. In contrast to some of its top rivals, like Gusto Payroll, Intuit QuickBooks Payroll offers a 30-day free trial, so you can take the software for a spin before committing. Each tier increases in functionality and features, with an additional fixed amount per employee per month, catering to growing businesses. QuickBooks Online Payroll’s Core plan has a notably low per-employee fee that ensures small businesses save money as they add employees.

This may influence how and where their products appear on our site, but vendors cannot pay to influence the content of our reviews. We may be compensated by vendors who appear on this page through methods such as affiliate links or sponsored partnerships. OnPay stands out for its transparent pricing and comprehensive features. Intuit QuickBooks Payroll's diverse plans make it a popular payroll choice for small and midsize businesses. OnPay (2023): Payroll Software Comparison

0 kommentar(er)

0 kommentar(er)